Note: this is a part of our new course on Product Management. It will provide you with the basics you’ll need to succeed in your new role. You can sign up here!

The Product Manager’s most important job is to figure out what people want.

What should we build and why should we build it are the two questions that supercede all others.

So how do you, as a Product Manager, figure out what people want?

The answer is research. There are two types: internal and external.

Internal research

Hiten Shah once told me:

Find out what’s already working, and double down on that.

Your current customers (the people already paying for your product) are your best source for information. Figure out why they’re using your product, and you’ll get insight into:

- What you should build next

- What needs to be improved in the current product

- How to market the product

A good framework for doing this type of research is the Product-Market Fit Survey. Here’s a sample of a survey Hiten Shah did. Hiten used TypeForm, which is a great survey creation tool. You can also use survey.io, which already has the survey questions built in.

The key question in the survey is: How would you feel if you could no longer use [product]?

Sean Ellis of Survey.io describes why this is significant:

If you find that over 40% of your users are saying that they would be “very disappointed” without your product, there is a great chance you can build sustainable, scalable customer acquisition growth on this “must have” product. If you have not yet reached the 40% benchmark, the survey can help you focus your efforts getting there.

Sean originally came up with the 40% benchmark by studying 1000 startups.

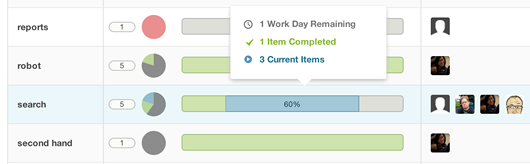

I like to add an additional question to my product-market fit surveys, which is the Net Promoter Score question (NPS): How likely are you to recommend Sprintly to a friend or colleague?

NPS helps you break your current customers into three groups:

- Promoters (score 9-10): your biggest fans. Enthusiastically use the product and tell others about it. (Example)

- Passives (score 7-8): people who are satisfied, but might be willing to switch products.

- Detractors (score 0-6): unhappy users who might be generating negative word of mouth.

To get your final score you subtract the percentage of detractors from the percentage of promoters.

My friend Corbett ran an NPS survey for his company, and shared the results publicly:

If you had 100% promoters, with no detractors or passives, your score would equal 100. But companies rarely score higher than 70. In fact, the average company earns somewhere between 5 and 10. Amazon.com earned a 76 in 2012 and Apple earned a 71. Anything between 0 and 50 is considered good, between 50 and 70 is excellent, and above 70 is “world class.”

The product-market fit survey, combined with NPS, will give you powerful insights into why your customers are using your app. You can also discover why some customers are unhappy, and make progress to fix those problems.

External research

The best part about the techniques I just taught you is they can also be applied externally. You can run these same surveys for your competitors.

This is exactly what Hiten Shah did when he launched his Slack research project.

To do this yourself, just duplicate the survey you created for your customers, and replace your product’s name with your competitor’s name.

Naturally, you’ll want to be covert about running these surveys (or better yet, hire a company to do it for you).

While these are harder surveys to run, the information you’ll garner from them is invaluable. Understanding why someone uses a competitor will help you understand what you can do to get people to switch to your product.

The next lesson

That’s it for today! The next lesson delves into the topic of identifying product opportunities in the market. You can subscribe to all five (free) lessons here.